Understanding Health Insurance

One of the most important investments we can make is having health insurance. Problems like illnesses, injuries and any other medical setbacks can be significantly expensive if they necessitate visits to the hospital and procedures such as surgery. Maintaining adequate health coverage is the best method to ensure that you do not feel hampered when you need to attend emergency medical expenses by yourself.

According to reports provided by the Kaiser Family Foundation, approximately 47 million or 15% of the population of the nonelderly were not insured by the year 2012. As such, these people had to pay 33% of their medical expenses by themselves. They also encountered higher bills than the people who had health coverage. Information from hospitals shows that residential treatment can cost as much as $10,000 per visit.

According to reports provided by the Kaiser Family Foundation, approximately 47 million or 15% of the population of the nonelderly were not insured by the year 2012. As such, these people had to pay 33% of their medical expenses by themselves. They also encountered higher bills than the people who had health coverage. Information from hospitals shows that residential treatment can cost as much as $10,000 per visit.

If you do not want to bear these expenses, you will need to invest in health insurance and do so appropriately. In this article, we are trying to give you some of the fundamental concepts which govern the medical insurance industry and some popular sources of health coverage. Our objective is to ease your burden while educating you about the options available options.

The Basics

When you decide to purchase a cost-effective health insurance coverage, you must understand the terminologies that are used in the industry. This is one of the initial steps that will prove helpful in obtaining a cost-effective coverage plan. Let us begin by giving you a few key definitions.

Premium.

Premium.

This is the amount that you are required to pay the insurance company for the coverage every month or year.

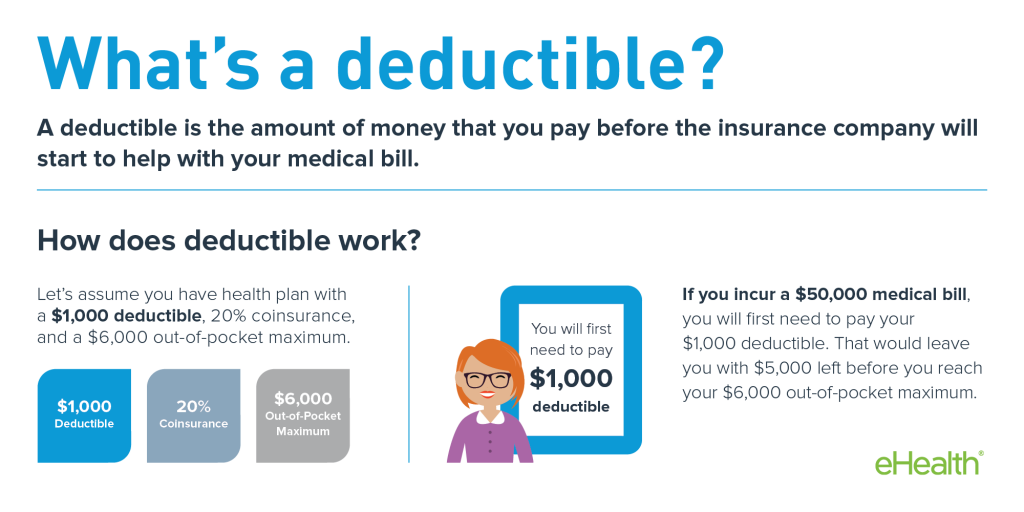

Deductible.

Deductible.

This is the fee you must pay from your pocket before the coverage begins. The amounts are generally rounded off at figures of $500 or $1000. Usually, the lower the premium, the higher the deductible.

This is the fee you must pay from your pocket before the coverage begins. The amounts are generally rounded off at figures of $500 or $1000. Usually, the lower the premium, the higher the deductible.

Coinsurance.

Coinsurance.

This is the money that will be owed to the medical provider after the deductible is paid. Coinsurance is typically set as a percentage of the entire bill.

Co-pay.

Co-pay.

This insurance plan is similar to coinsurance with a single exception. You will not be required to wait until the deductible has been paid, but you are required to make a copayment when you receive the service. Copayments are generally standardized by the plan you have chosen.

Out-of-pocket maximum.

Out-of-pocket maximum.

This is the money you pay as deductibles and charges for coinsurance before the insurer begins paying for all expenses that are covered.

In network.

In network.

This term refers to medical establishments and physicians that are providing patient services covered by the insurance plan. These are the most cost-effective options available for policyholders because the insurers have negotiated lower prices with their network providers.

Out-of-network.

Out-of-network.

These are the medical establishments and physicians that are not covered under your insurance plan. Services obtained from out-of-network providers are expensive because the insurer has not negotiated lower prices with them.

Pre-existing conditions.

Pre-existing conditions.

These are any chronic diseases, disabilities or any of the conditions you may have when making the application. Symptoms and ongoing treatments for pre-existing conditions can result in higher premiums being charged by the insurance company.

Waiting period.

Waiting period.

A number of employer-sponsored plans for insurance mandate a waiting period of 90 days before the employees can enroll in their insurance plans.

Enrollment period.

Enrollment period.

This is the period of time during which you can make an application for health insurance or modify the plan you have chosen to include no spouse or children. Policyholders do not have the option of adjusting their plan until the next open enrollment unless they experience events such as marriage, divorce, changes to personal or household income, relocation, the birth of a child, etc.

This is the period of time during which you can make an application for health insurance or modify the plan you have chosen to include no spouse or children. Policyholders do not have the option of adjusting their plan until the next open enrollment unless they experience events such as marriage, divorce, changes to personal or household income, relocation, the birth of a child, etc.

Where Can You Get The Coverage You Need?

Where Can You Get The Coverage You Need?

Within the United States, most health insurance coverage options fall under a couple of general categories. You may purchase individual coverage for yourself and your family members by contacting insurance companies directly. You can also opt for group coverage if you are an eligible employee or a student. The parameters and regulations pertaining to either type of coverages have changed significantly with the introduction of the Affordable Care Act.

More in Motivation

-

`

Amanda Bynes Pregnant at 13? Debunking the Rumors

In recent years, the internet has been ablaze with rumors surrounding former child star Amanda Bynes, particularly regarding allegations of a...

July 1, 2024 -

`

Can Baking Soda Clean Your Lungs?

Years of inhaling cigarette smoke, pollution, and other toxins can leave you longing for a way to cleanse your lungs. The...

June 27, 2024 -

`

How to Build Muscle Mass After 60? 5 Proven Strategies

Curious about how to build muscle mass after 60? You are not alone. And the good news is that it is...

June 20, 2024 -

`

Prediabetic Foods That Can Lower Your Blood Sugar in 2024

Prediabetes is a health condition characterized by blood sugar levels that are higher than normal but not high enough to be...

June 13, 2024 -

`

Kelly Clarkson’s Weight Loss Journey | Here Are the Details

Kelly Clarkson’s weight loss has been a hot topic among fans and media alike. The iconic American singer and host of...

June 3, 2024 -

`

Essential Vitamins for Gut Health – A Comprehensive Guide

Our gut does more than just digest food – it plays a vital role in immunity, mood, and overall health. But...

May 30, 2024 -

`

Looking to Build A Stronger Sculpted Back? Try Cable Back Workouts

Back workouts using cables, or cable back workouts as they are commonly known, have become the gold standard for anyone aiming...

May 22, 2024 -

`

How Much Water Should I Drink on Creatine? Hydration Tips

Creatine, a popular supplement among athletes and fitness enthusiasts, has gained widespread recognition for its ability to enhance muscle strength, power,...

May 17, 2024 -

`

What Is Bruce Willis’s Net Worth? Get the Inside Scoop Here!

Bruce Willis, the action hero who has saved the day countless times on screen, has built a legendary career. But how...

May 11, 2024

You must be logged in to post a comment Login